Mulling over the finances and feasibility of this lifestyle will require MANY spreadsheets!

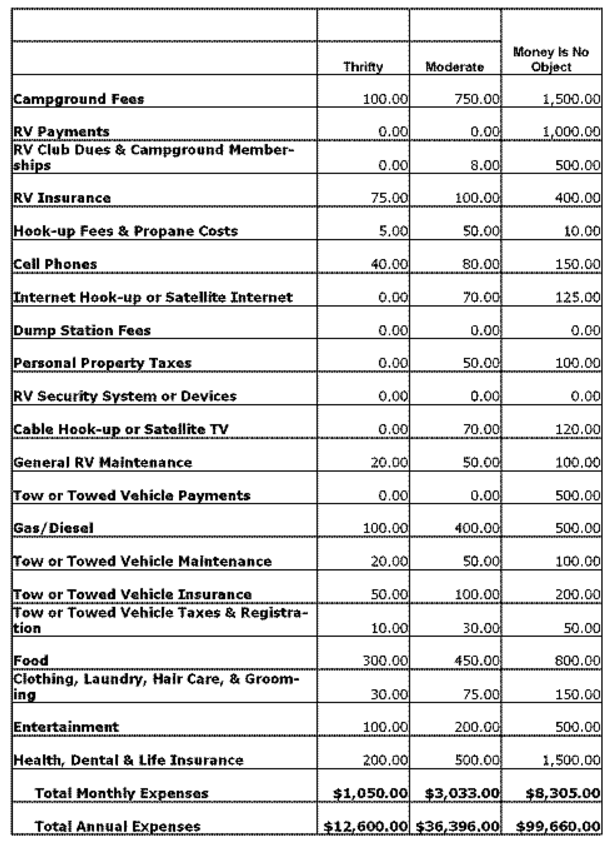

The monthly expenses can run quite a broad gamut depending on whether you plan to live “Thrifty”, “Moderate” or “Money’s No Object”, as the sample budgets from RV Dreams below shows:

The reason we call it a “lifestyle” change is because we are NOT retiring! But we will be making a MAJOR change in our work styles!

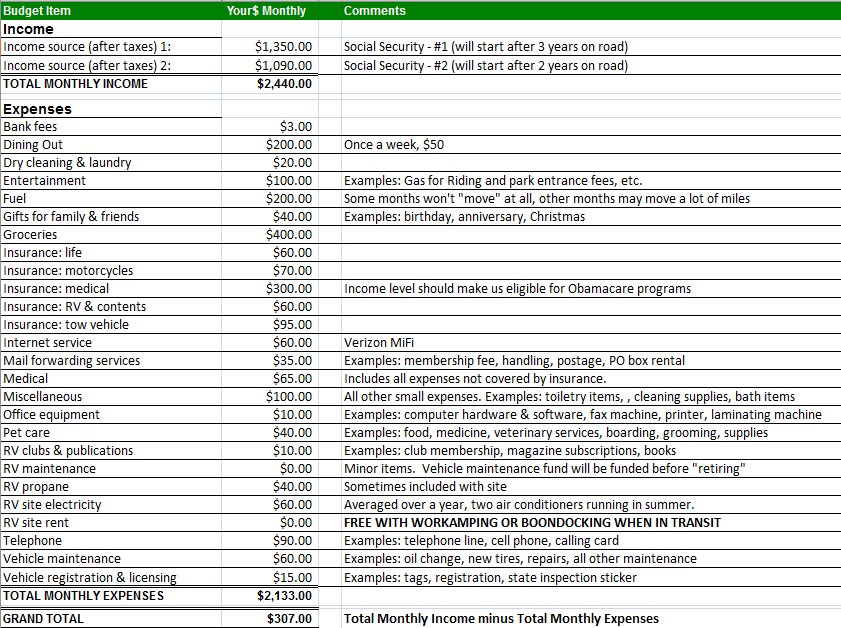

Depending on our savings, we might have to continue to work the first 3 to 4 years after embarking on this new way of life until we reach Social Security age, in some capacity for OUR budget to balance. Profit from the sale of our house will buy the RV and truck to tow it. We will be debt free by then, and I can not imagine doing this with any large monthly payment.

Below is a pretty specific budget for us that will be valid once our Social Security kicks in (age 62). As you can see, us MAKING our budget is contingent on at least one of us working a work camping gig so that the sites are always free. For the first 2-3 years, one of us will also have to work at a paying job – local or online – to meet the budget. One factor that’s vague below is medical insurance, since that may change a million times between then and now.

(This Budget Spreadsheet download available at Changing Gears)